Why Term Life Insurance is Better Than Whole Life – Explained!

Introduction

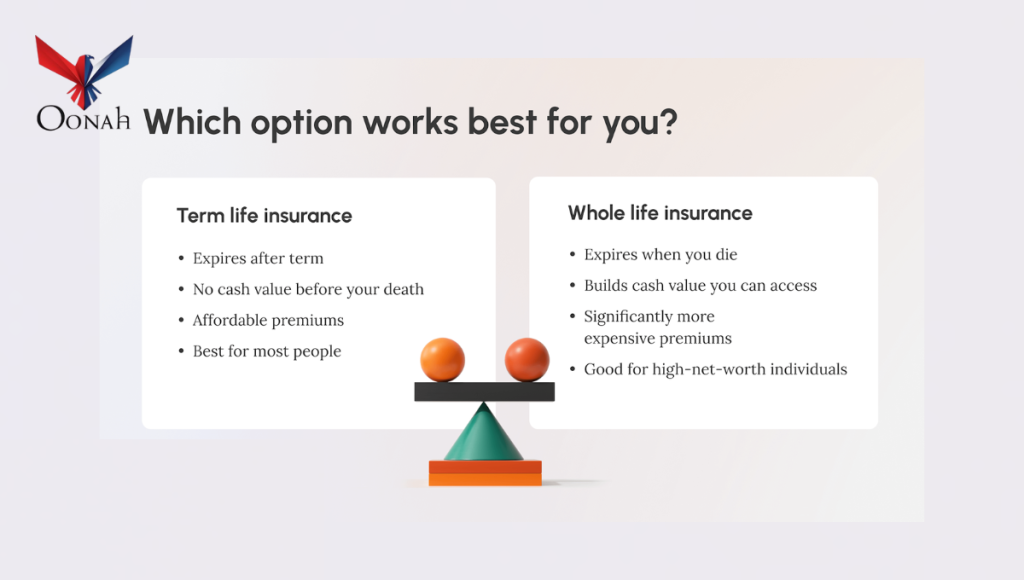

When choosing life insurance, you’ll often face a critical decision: Term Life vs. Whole Life Insurance. While both provide financial protection, they serve different purposes and come with different costs.

So, why do financial experts and advisors often recommend term life insurance over whole life? Let’s break it down.

1. Term Life Insurance is More Affordable

One of the biggest advantages of term life insurance is its low cost.

✔ Example: A 30-year-old non-smoker can get a $500,000 term life policy for around $20/month, while a whole life policy with the same coverage could cost $300+ per month.

💡 Why? Term life provides pure insurance coverage, while whole life combines insurance + investment, making it much more expensive.

2. You Only Pay for the Years You Need Coverage

Term life insurance provides coverage for a fixed period (10, 20, or 30 years), while whole life lasts forever.

✔ If you only need insurance until your kids are grown or your mortgage is paid off, term life ensures you don’t overpay for unnecessary coverage.

3. Better Investment Returns Elsewhere

Whole life insurance includes a cash value component, but its returns are low (often 2-4% per year).

💡 Instead of paying high premiums for whole life, you can:

✅ Buy a term life policy and invest the difference in stocks, real estate, or retirement accounts for higher growth.

📊 Example: Investing just $100/month in an index fund for 30 years could grow to $200,000+, while whole life’s cash value may only be a fraction of that.

4. Simpler and Easier to Understand

✔ Term life insurance is straightforward: You pay a premium → Your family gets a payout if you pass away.

❌ Whole life insurance is complicated with:

- Fees & hidden costs

- Cash value rules

- Low investment returns

💡 If you want pure life insurance without the hassle, term life is the way to go.

5. More Flexibility for Your Financial Future

Term life insurance gives you options. Once your policy ends, you can:

✔ Extend it if needed

✔ Convert it to permanent insurance (some policies allow this)

✔ Drop it because you’ve built wealth and no longer need life insurance

❌ With whole life, you’re locked into expensive payments even when you might no longer need coverage.

When Does Whole Life Insurance Make Sense?

Whole life insurance may be useful if you:

✔ Have high net worth and need estate tax planning

✔ Want to leave an inheritance tax-free

✔ Have a lifelong dependent (e.g., special needs child)

For most people, however, term life is the smarter choice.

Final Verdict: Term Life Insurance Wins

✔ Cheaper premiums = More money for investing

✔ Simple coverage without extra fees

✔ Better flexibility as your financial situation changes

💡 Bottom Line: If you need affordable and straightforward life insurance, term life is the clear winner.

🚀 Start today: Get a quote for term life insurance and secure your family’s future at a fraction of the cost!

Explore More on Oonah.xyz:

- Best Life Insurance Policies for Long-Term Security (2025 Guide)

- How to Get the Best Mortgage Rates & Save Thousands

- Top 10 High-Yield Savings Accounts with Best Interest Rates

- Real Estate vs. Stocks: Which One is the Better Investment?

🚀 Explore More AI-Powered Insights:

- AI Content Generation – Learn how AI is transforming content writing! 📝

- AI SEO & Marketing Automation – Discover AI-driven marketing strategies to boost traffic! 📈

- AI Image & Video Creation – Unlock the power of AI for professional-grade visuals! 🎥

- AI Chatbots & Virtual Assistants – Automate conversations with intelligent AI assistants! 🤖

👉 Explore more AI-powered resources at vmjuii.xyz!